ExportGeneral Corporation

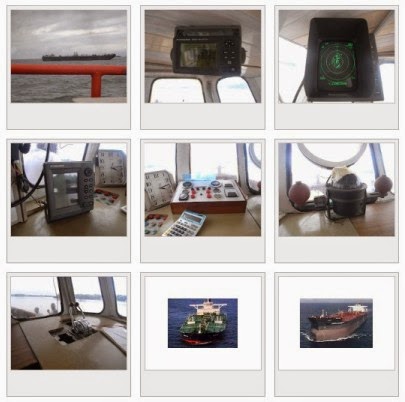

ExportGeneral Corp is a leader in the of Nigerian Bonny Light Crude Oil (BLCO) sales market. As a privately held company, Export General Corp is committed to and is focused on delivering reliable services to all her clients. ExportGeneral Corporation is determined to continue to grow in the energy sector and to become one of the recognized leaders in the Nigerian oil and gas industry.

ExportGeneral Corp is a leader in the of Nigerian Bonny Light Crude Oil (BLCO) sales market. As a privately held company, Export General Corp is committed to and is focused on delivering reliable services to all her clients. ExportGeneral Corporation is determined to continue to grow in the energy sector and to become one of the recognized leaders in the Nigerian oil and gas industry.

Simplifying Nigerian Bonny Light Crude Oil, BLCO Buying Through Export General Corporation

Export General Corporation has an excellent track record of reliability in the supply of Bonny light crude oil, BLCO. We protect our buyers with 2% Performance Bond while we also expect protection from our customers with bank instrument from the world's top banks. We deliver on TTO, TTT, CIF and FOB basis.

Export General Corporation has an excellent track record of reliability in the supply of Bonny light crude oil, BLCO. We protect our buyers with 2% Performance Bond while we also expect protection from our customers with bank instrument from the world's top banks. We deliver on TTO, TTT, CIF and FOB basis.

If you wish to purchase Bonny Light Crude Oil from a reliable seller, contact us today to commence a comprehensive purchase procedure.

Tuesday 31 March 2020

Oil posts worst quarter ever as physical market craters

Saudis unleash oil exports for April, as promised

IHS Markit sees forced oil production cuts of 10MMbpd ahead

Parsley Energy CEO seeks 20% cut in Texas oil output

Oil selling below $10/bbl at key American hubs

Trelleborg to supply cable protection for world’s largest offshore wind farm

Monday 30 March 2020

Shale drillers ask oil regulators to curb output, countering industry groups

Daily Brief podcast, Monday, March 30th

Trump, Putin discuss falling oil prices

Saudi Aramco considers $10B pipeline stake sale to raise cash

Trump, Putin to discuss falling oil prices today

Equinor sees Johan Sverdrup production ramp faster than expected

Oil hits 17-year low with market awash in crude

Aker Solutions secures Brunei brownfield services contract

Coronavirus delays hindering oil and gas maintenance regimes

Pipelines ask U.S. drillers to slow output as storage capacity dwindles

Consumption drop most dangerous for U.S., Russian, Canadian crude

Sunday 29 March 2020

Experts see a future for shale: ‘Rocks don’t go bankrupt’

Scores of drilling rigs idled as downturn gains momentum

Some Canadian crude costs more to ship than to buy

OPEC members balk at request to review virus’ impact on markets

Russia nationalizes Venezuelan assets to skirt U.S. sanctions

Friday 27 March 2020

California judge upholds Trump’s repeal of fracing regulations on public lands

Daily Brief podcast, Friday, March 27th

Saudis dispel rumors, saying no talks with Moscow on oil output

Oil at historic lows beginning to force shut-in of wells

Thursday 26 March 2020

World Oil survey: Trump administration would have to impose U.S. import tariff

Oil resumes plunge after IEA warns of ‘free fall’ in demand

Daily Brief podcast, Thursday, March 26th

Oxy calls truce with Carl Icahn, makes changes to its board

Energy Department withdraws tender to fill Strategic Petroleum Reserve

Oil market fears U.S. is running out of crude storage capacity

Pipeline companies concerned traders may use their network for oil storage

Venezuela’s output plunges, may be shutting in wells

Wednesday 25 March 2020

World Oil survey: Near majority of U.S. firms thinks import tariff could help

Daily Brief podcast, Wednesday, March 25th

Funding to refill U.S. Strategic Petroleum Reserve cut from stimulus plan

U.S. urges Saudis to reassure global energy and financial markets

Texas RRC Chairman Wayne Christian: We must stabilize worldwide oil markets

Oil trader says demand is down as much as 20% from last year

Oceaneering secures maintenance build and inspection contract with GOLAR for FLNG

Fugro, SEA-KIT join to advance uncrewed surface vessels

Equinor halts U.S. land activities as part of $3B cost-reduction plan

Oil prices are even lower than they appear, thanks to heavy discounting

Oil rises on U.S. stimulus plan, as global price war continues

Tuesday 24 March 2020

World Oil survey: U.S. industry prefers some form of import tariff

Shale service leaders warn of a bigger crash this time around

Chevron cuts spending by $4 billion, suspends share buybacks

Tullow cancels Maersk Venturer contract offshore Ghana

These countries have the most firepower in the oil price war

Oil steadies on Fed action, hope for U.S.-Saudi talks

Monday 23 March 2020

World Oil survey results: U.S. industry favors strong government action

Daily Brief podcast, Monday, March 23rd

Talos reduces costs, expects positive free cash flow in 2020

Oxy nears truce with Icahn, adding new directors to its board

Aker lands 20-year umbilicals master order with Chevron

Total, Shell announce multi-billion-dollar budget cuts as oil continues decline

Wärtsilä creates testbed for smart marine solutions

Oil slips as OPEC-Texas agreement looks less likely

Sunday 22 March 2020

Husky suspends West White Rose project on Covid-19 concerns

Shale plays, oil patch see tens of thousands of layoffs across the industry

Saturday 21 March 2020

World Oil analysis: Research shows current oil price collapse near record proportions

Oxy reaches out to investors for ways to address $39B debt

Oil’s demand plunge doing more damage than the price war

Friday 20 March 2020

Daily Brief podcast, Friday, March 20th

OPEC secretary general invites Texas RRC’s Sitton to Vienna meeting

Texas RRC chairman Wayne Christian comments on oil markets, proration, and SPR

Shale patch sees tens of thousands of layoffs across the industry

Total expands renewables portfolio with wind power investment

Seeing Saudi action as “oil blackmail”, Putin signals resistance

ION to divest land seismic equipment JV for $12 million

Texas regulator considers oil output cuts for the first time in decades

Thursday 19 March 2020

Oil price scores largest one-day percentage increase in traded oil price in NYMEX history

Oil’s rebound from 18-year low comes as economies attempt a recovery

Oil price scores largest one-day percentage increase in the traded oil price in NYMEX history

PSS Industrial Group appoints industry veteran and leader, Robert Workman, as Chief Executive Officer

Negative oil prices are rare, but not impossible

Strategic oil reserve buy could benefit smaller shale drillers

Trump may intervene in oil price war to stabilize prices

Daily Brief podcast, Thursday, March 19th

Treasury secretary calls for U.S. to add $20B of oil to strategic reserve

Oil war hits home as Saudis cut nearly 5% from national budget

Storing crude at sea becomes a profitable option for traders

Oil rebounds from 18-year low as economies attempt a recovery

Wednesday 18 March 2020

World Oil analysis: Current oil price drop worst since Asian Financial Crisis

World Oil Daily Brief podcast, Wednesday, March 18th

Kremlin says Russia “would like to see crude prices higher”

World Oil launches oil import tariff survey; early results show clear trends

Halliburton furloughs 3,500 staff at Houston Headquarters

ConocoPhillips to implement $2.2B in cash-saving measures

Tendeka lands four-year zonal isolation contract in Malaysia

Weatherford completes novel cased-hole sidetrack in ultra-deep Gulf of Mexico waters

Tracerco secures first baseline subsea inspection project for Gulf of Mexico pipelay development

Oil falls to lowest since 2003 as global economy stalls

History shows the 2020 oil-price war won’t end soon

Tuesday 17 March 2020

The oil-price war Russia helped create complicates their Arctic plans

U.S. senators urge Saudis to calm oil market tensions

Hess cuts CAPEX and exploration budget by $800 million, focuses on Guyana

Total tallies new gas, condensates discovery in UK North Sea

Biden faces skeptical energy workers in swing states

ExxonMobil planning significant CAPEX, OPEX cuts due to oil price war and pandemic

China refuses oil from Russian companies hit by U.S. sanctions

Monday 16 March 2020

Canadian operators cut nearly $2.5 billion from 2020 budgets

Daily Brief podcast, Monday, March 16th

Russia keeps Saudis at arm’s length, as oil price fall continues

BP can cut spending by 20% this year, CFO says

Pioneer CEO says U.S. oil output could drop 20% on shale retreat

CNOOC tallies “large-sized” discovery in Bohai Bay

Global oil use heads for steepest annual contraction in history

Sunday 15 March 2020

Oil’s crash is both a help and a hazard for LNG export projects

Aramco slashes CAPEX as the oil-price war hits home

Saturday 14 March 2020

Trump to fill U.S. Strategic Petroleum Reserve “to the very top”

Friday 13 March 2020

2020 Offshore Technology Conference in Houston postponed

Daily Brief podcast, Friday, March 13th

Abu Dhabi discounts its Murban crude in growing oil price war

Trump to declare a national emergency to speed virus response

Oxy swallows ‘poison pill’ as Carl Icahn tries to oust its board of directors

Oil hedges that burned shale drillers in 2014 cause trouble again

Jones Act waiver floated as a stimulus for U.S. oil companies

Thursday 12 March 2020

U.S. sanctions second Rosneft subsidiary for shipping Venezuelan crude

Tariff on Saudi crude may be Trump’s answer to oil-price war

Daily Brief podcast, Thursday, March 12th

Shale billionaire to file anti-dumping complaint against Saudis

Tarriff on Saudi crude may be Trump’s answer to oil-price war

Stress Engineering Services launches new digital flex joint angle monitoring system

Russian producers equipped to compete with flood of Saudi oil

Saudis pledge huge oil supply increases to European refiners

Wednesday 11 March 2020

Shale insiders snapping up stock as prices hit record lows

Daily Brief podcast, Wednesday, March 11th

U.S. oil output to fall next year, for the first time since 2016

Betting on a bailout, investors rush into U.S. energy funds

BJ Services and Atheon ink contract for next-gen gas fueled frac fleet

DOE encouraged to add 78MMbbl of U.S. oil to strategic reserve

ADNOC joins price war, pledging to boost supply to 4 MMbpd

Saudis want to raise oil output capacity by a further 1 MMbpd

Coronavirus case reported on Equinor’s Martin Linge field offshore Norway

Tuesday 10 March 2020

Daily Brief podcast, Tuesday, March 10th

Saudis book more supertankers to help flood the oil market

U.S. suspends sale from Strategic Petroleum Reserve on price dive

Russia keeps door open for OPEC amid threats to raise output

Oxy plans spending cut to protect dividend payments

Oil price havoc derails offshore energy IPOs

Saudis escalate oil price war with another output hike

Are America’s days as a net oil exporter numbered?

Monday 9 March 2020

Oil tests recovery from historic crash following global price war

Almost all new wells lose money in shale’s ‘new normal’

Mnuchin wants ‘orderly’ oil markets in talk with Russian ambassador

Trump to weigh options to aid U.S. energy producers amid oil shocks

Daily Brief Podcast, Monday, March 9th

Wall Street slashing ratings on shale producers

Rosneft to raise output as soon as current OPEC+ deal ends

Houston-based Tellurian slashes staff to save LNG project

Shale drillers facing uncharted territory in worst oil bust yet

Saudi’s oil-price war begins as buyers snap up cheap crude

Oil price meltdown provides some benefit to LNG importers

Sunday 8 March 2020

A look at how the oil price crash is upending markets

Oil plunges 30% as Saudi-Russian price fight builds

Canada’s LNG dreams fade as blockades add new costs to industry

North Sea oil producers face near-term carbon target challenge

Russia's stronger economy lets Putin stare down OPEC

Aramco’s drop below IPO price deals blow to Saudi economic plan

Putin dumps OPEC to start a war with America’s shale oil industry

OPEC’s failure impacts every corner of the global oil market

Australia inks deal with U.S. for access to Strategic Petroleum Reserve

Saudis plan oil-price war, slashing prices while raising output

Friday 6 March 2020

Falling oil is a shot in the arm for U.S. gas drillers

Daily Brief podcast, Friday, March 6th

Russian resistance hammers oil prices, pushing OPEC to the brink

API president reaffirms oil’s importance to Colorado in visit

Thursday 5 March 2020

Aramco delays April oil pricing, as it waits for OPEC’s decision

Meritage Midstream commissions Powder River basin natural gas plant

The show will go on, says OTC 2020 organizers

Exxon to cut Permian growth by 10% in response to price slump

TGS delivers milestone North Sea OBN project

Aker BP taps Tendeka for sand-face completion program offshore Norway

Aker BP and Framo sign “smart” offshore maintenance contract

Equinor, Shell team up on digital transformation projects

More Chinese LNG orders canceled under new force majeure claims

Wednesday 4 March 2020

U.S. stimulus boosts oil while divided OPEC+ debates deeper cuts

Shale borrowers see collateral values take a hit as oil outlook darkens

Emerson, QRI team up on AI-based EandP analytics

Travel restrictions, crew screenings – service companies ramp up coronavirus responses

Daily Brief podcast, Wednesday, March 4th

Oil price recovery ends as Russia walks out of OPEC+ meeting

Wall Street consensus builds around oil market contraction

Chevron won’t follow rivals’ ‘aspirational’ climate goals, CEO says

Texas regulator Ryan Sitton loses to GOP challenger in primary upset

Saudis lobby for million-plus-barrel OPEC cuts, extending oil’s gains

Tuesday 3 March 2020

SPE/IADC Drilling Conference opens with well-received program

Daily Brief podcast, Tuesday, March 3rd

OPEC may extend cuts beyond February’s 600,000 bpd target

Chevron plans $80B in dividends as shale production ramps up

Sandvik lands first steel tube umbilical order offshore Brazil

ExxonMobil proposes oil and gas methane-regulation framework

Halliburton reduces well time and costs with new drilling motor

Weatherford debuts Centro well delivery data platform

Oil-state senators push back on Trump’s plan to end biofuel waivers

Alaska’s $67B sovereign fund irked by green-leaning banks

Oil rally continues as OPEC+, G7 pledge to safeguard markets

Monday 2 March 2020

Daily Brief podcast, Monday, March 2nd

Ampelmann enters Guyana with SBM Offshore contract

TGS completes carbon capture storage assessment in Canada

Total-Occidental’s Ghana deal delayed by $500m tax claim

Beleaguered LNG traders await bad news from Japan

China’s drive to restart its economy revives fake data concerns

Inspired by Aramco IPO results, Bahrain may follow suit

Guyana’s election to decide who controls the nation’s oil boom

Hope for action from OPEC, central banks halts oil’s freefall

CERAWeek canceled after WHO increases virus threat level

Sunday 1 March 2020

Stricter drilling rules didn’t slow Colorado oil production

Maduro names new PDVSA leadership following “energy emergency”